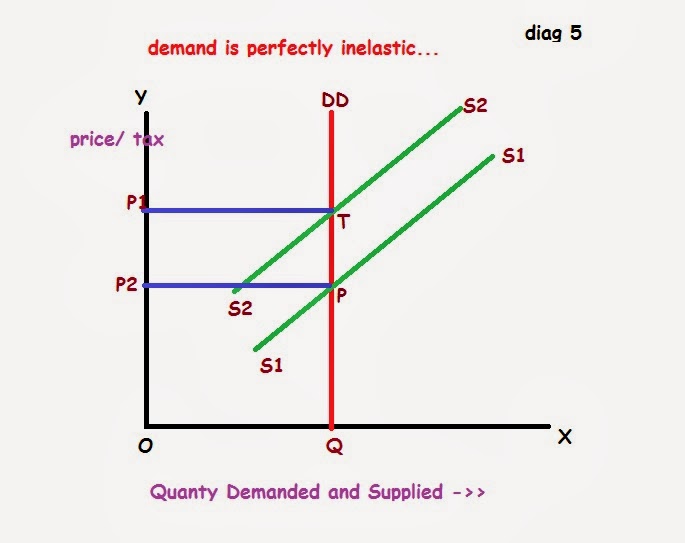

A) falls primarily on consumers. How does tax affect a perfectly inelastic supply? If one party is comparatively more inelastic than the other, they will pay the majority of the tax.

Microeconomics Practice Problem Tax Burdens with

If demand is more inelastic than supply, consumers bear most of the tax burden, and if supply is more inelastic than demand, sellers bear most of the tax burden.

Who bears the burden of this tax?

E)mostly by consumers but partially by producers. The tax burden is most heavily imposed on buyers. If the supply curve is perfectly inelastic, the burden of a tax on suppliers is borne: (dp/dt = −1 and dq/dt = 0) 1) ε s = 0 [inelastic supply] (e.g.:

Sellers of the good will bear most of the burden of the tax.

When the demand is inelastic, consumers are not very responsive to price changes, and the quantity demanded remains relatively constant when the tax is introduced. Conversely, if demand is perfectly elastic or supply is perfectly inelastic, producers will bear the entire burden of a tax. Asked aug 30, 2019 in economics by shnice2. Perfectly inelastic supply means that suppliers will provide the same amount of product regardless of the price.

New quantity traded, qt , the supplier gets $2 per unit (pts), the government.

The problem is taken from principles of micr. As supply demand grows relatively more elasticproducers consumers bear a smaller burden of the tax. When the demand is inelastic, consumers are not very responsive to price changes, and the quantity demanded remains relatively constant when the tax is introduced. Who bears the tax burden when supply is perfectly elastic?

When one party bears the tax burden if supply is perfectly elastic or demand is perfectly inelastic, consumers will bear the entire burden of a tax.

If supply is perfectly inelastic and demand is relatively elastic, the burden of an excise tax: If demand is more inelastic than supply, consumers bear most of the tax burden, and if supply is more inelastic than demand, sellers bear most of the tax burden. The intuition for this is simple. If demand is extremely elastic, it is likely that _____ will bear most of the burden of a tax and that the deadweight loss will be relatively _____.

B) falls entirely on producers.

The greater part of the incidence is. The right graph has an elastic supply curve and an inelastic demand curve. D) falls entirely on consumers. The intuition for this is simple.

There is a close substitute, and

The tax falls more heavily on buyers than on sellers. Given an upward sloping supply curve, the more inelastic is demand, the greater the fraction of the burden of taxation that is borne by consumers. Buyers and sellers will each bear 50 percent of the burden of the tax. How does taxes affect inelastic demand?

Producers and consumers except in the rare cases of perfectly inelastic supply or demand for goods or inputs.

They do not reveal that people move up and down in the income distribution over time. It is the producers who are responsible for the price and the entire tax burden if the demand is perfectly elastic or the supply is perfectly inelastic. Asked aug 30, 2019 in economics by nejadeja. 14)in a market where supply and demand are

C)by both consumers and producers equally.

When a tax is imposed on a good for which the supply is relatively elastic and the demand is relatively inelastic, buyers of the good will bear most of the burden of the tax. This video shows how a tax burden is shared between consumers and producers when supply is perfectly inelastic. When the supply for a certain product is believed to be inelastic in the market then it can be said that the policy of imposing an additional rate of tax on suppliers of that product will result in fall in the whole tax incidence / tax burden over this supplier / producers only.this is the outcome of the inability and incapability of the producers to alter their. In this case, if a new sales tax.

Generally consumers and producers are neither perfectly elastic or inelastic, so the tax burden is shared between the two parties in varying proportions.

FIxed capacity and sunk investment, hard to convert). Perfectly competitive industry) when do producers bear the entire burden of the tax? What products are perfectly elastic? B)mostly by producers but partially by consumers.

Who bears the burden of the tax?

C) is shared evenly by consumers and producers. Tax incidence with inelastic supply. The burden of a tax falls most heavily on someone who can’t adjust to a price change. Gets $4 also and the consumer pays $6.

They show the incidence of a tax change only on those

Partly by the suppliers and mostly by the consumers if the demand curve is elastic. 1)if a tax is imposed on a good with a perfectly inelastic supply, the burden of the tax will be borne group of answer choices a)by consumers alone. If the demand for insulin is highly inelastic, the burden of a tax on insulin will be borne almost entirely by sellers. Burden tables are snapshots in time.

S = ∞[perfectly elastic supply] (e.g.:

That means buyers bear a bigger burden when demand is more inelastic, and sellers bear a bigger burden when supply is more inelastic.