See if you can fill in the table below: To show what i mean, i’m sharing the chart below. Interest rates, dividends, volatility, or lack of volatility.

What Every Canadian, and Every Investor, Needs To Know

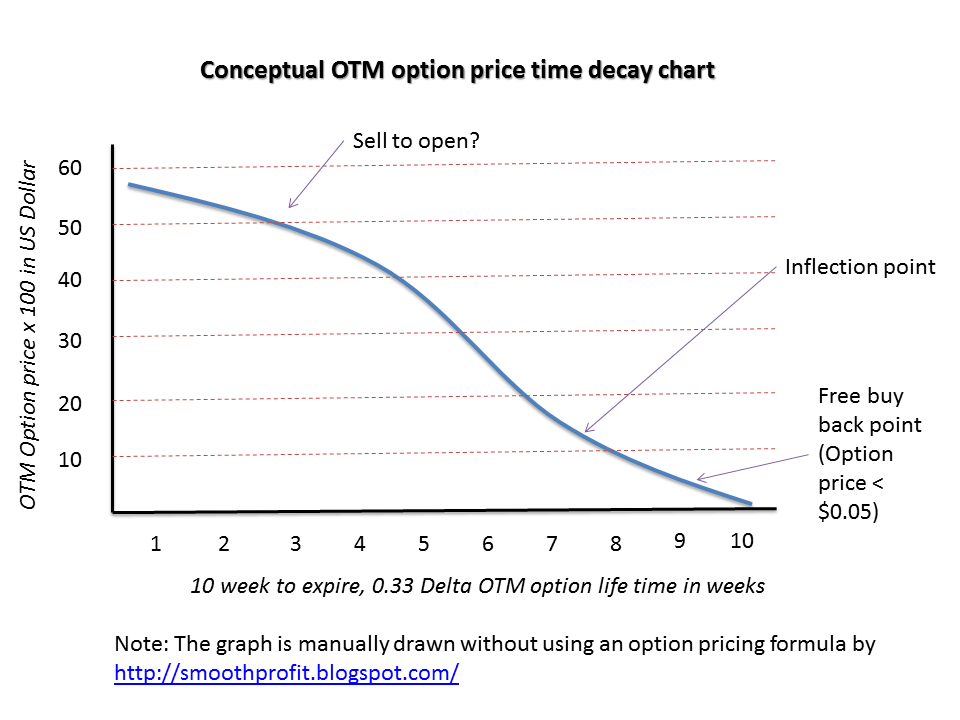

As you can see in the chart below, as time passes an options delta changes.

Weekly options and time decay.

Recall that weekly options are now very popular and functioning with the same decay but in a much shorter time frame. How options time decay destroys the s of calls and puts a big little primer on options robinhood theta time decay of our option premiums the blue collar investor the myth of option weekend decay six figure investing theta is the greek value describes decay of an option contract. This chart samples options over a fairly long time horizon. As explained above, time decay is the erosion of the value of options as time progresses.

Intrinsic value minimum = zero;

An option contract starts feeling the decay curve increasing when the option has about 45 days to expiration. From 60 to 30 days to expiration, the rate of decay began to accelerate. It increases rapidly again at about 30 days out and really starts losing its value in the last two weeks before expiration. This is like a boulder rolling down a hill.

By owning the leaps option, we had about 90 cents of time decay.

Time decay of options explained. Or in other words, theta decay is theory about how the market should price options, not not necessarily how it actually does. There are so many different characteristics of options that i talk a lot about with my options coaching students. As i mentioned in my options for beginners guide, time decay (known as theta) erodes the price of an option over time and is the primary reason why an investor would take the other side of your options trade (selling to open an options contract).

The further it goes down the hill, the more steam it picks up until the hill ends.

However, in the last 30 days, the decay accelerates to the point where it looks like it is plunging downward during the last week of life of the option. Here is a chart that looks at general theta amounts for different implied volatilities: The most important part of time value is the decay in price. To explain further, we must look at how the price of an option is effectively made up of two separate components:

But one of the more popular subjects is that premium sellers see the most dramatic erosion of the time value of options they have sold during the last week of the options cycle.

Time decay is the rate of change in value to an option's price as it nears expiration. Charm seeks to measure this change. An option’s theta can be calculated as follows: May 17.5 25.30 may 20 22.80 may 22.5 20.30 may 25 18.00 may 40 5.50 june 20 23.20 june 22.5 20.90

Time value is considered the part of the option’s price that’s based on the time remaining until it expires.

You will remember the equation for the value of an option: This depicts time decay in a real world application with all of the particulars being the same: Written by kupis on september 11,. Option premium = intrinsic value + time value (extrinsic value)

By selling the commodity options and.

You can see that it begins to decay rather slowly as the remaining life in the option drops from 60 days to 30 days. Options time decay can be one of the most insidious forces to lose you money as you buy call and put options. If you need a brokerage account and you'd like to trade with tastyworks, get one projectoption course for free when you open and fund your first tastyworks b. Intrinsic value is relatively simple to calculate because it essentially.

Theta is expressed as a negative number since the passage of time will decrease time value.

Intrinsic value and extrinsic value.

![Option Butterfly Spread Tutorial [Infographic] Power](https://i2.wp.com/www.powercycletrading.com/wp-content/uploads/2018/08/Time-Remaining-Until-Expiration-Date-File-jpeg-COMPRESSED-1024x576.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Time_Decay_Apr_2020-01-a2824c7ac5ad47ed9082ea52f9ace031.jpg)