Set up your regression as if you were going to run it by putting your outcome (dependent) variable and predictor (independent) variables in the. Demonstrate a linear relationship between them. (a) show you how to detect outliers using spss statistics;

Regression Analysis Spss Interpretation

The durbin watson statistic is a test statistic used in statistics to detect autocorrelation in the residuals from a regression analysis.

And (b) discuss some of the options you have in.

Ideally, you want your dependent variables to be moderately correlated with each other. Pharmasug 2018 agenda online registration by cvent. The durbin watson statistic will always assume a value between 0 and 4. Spss also provides collinearity diagnostics within the statistics

Exercise of multicollinearity ardl models part ii bounds tests dave giles.

In ordinary least square (ols) regression analysis, multicollinearity exists when two or more of the independent variables independent variable an independent variable is an input, assumption, or driver that is changed in order to assess its impact on a dependent variable (the outcome). Finance add in for excel latest version hoadley. From laerd statistics multiple regression analysis using spss introduction multiple regression is an extension of simple linear regression. The following tutorial shows you how to use the collinearity diagnostics table to further analyze multicollinearity in your multiple regressions.

The variable we want to predict is called the dependent variable (or sometimes, the outcome, target or criterion variable).

Multicollinearity in regression analysis occurs when two or more predictor variables are highly correlated to each other, such that they do not provide unique or independent information in the regression model. However, this is required that dv should be continuous data. Multicollinearity test example using spss | after the normality of the data in the regression model are met, the next step to determine whether there is similarity between the independent variables in a model it is necessary to multicollinearity test. Using spss, multicollinearity test can be checked in linear regression model.

Data analytics lt university of illinois springfield.

Variance inflation factor and multicollinearity. Spss applications data analysis luchsinger mathematics ag. Data analytics lt university of illinois springfield. A value of dw =.

Now we run a multiple regression analysis using spss.

Moderator analysis with a dichotomous moderator laerd. (2) use the spss factor analysis procedure to obtain the principal component matrix of the independent variables x 1, x 3 and x 4 and the cumulative variance proportion of different principal components (, pp. Including all calculating processes of the principal component regression and all operations of linear regression, factor analysis, descriptives, compute variable and bivariate correclations procedures in spss 10.0. Exercise of multicollinearity list e thesis faculty of public health mahidol university.

To investigate possible multicollinearity, first look at the correlation coefficients for each pair of continuous (scale) variables.

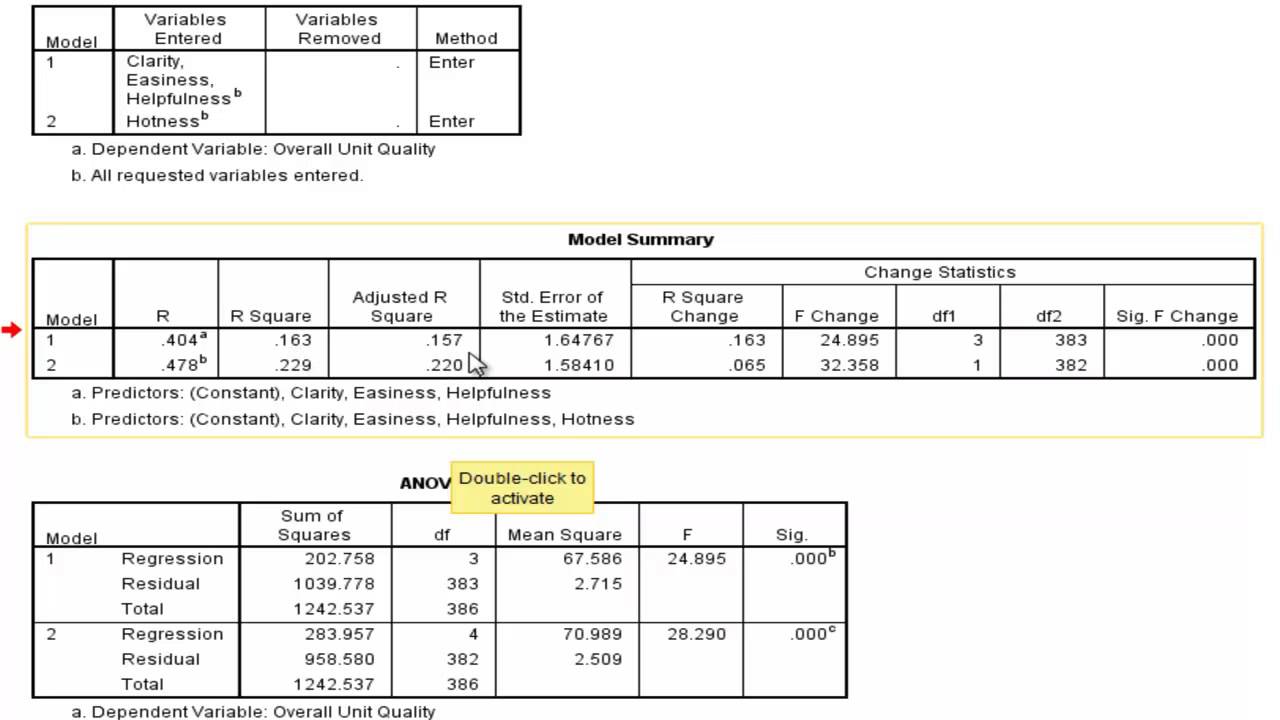

We obtain the following results: The paper uses an example to describe how to do principal component regression analysis with spss 10.0: These facts clearly indicate that there is a collinearity between x 1 and x 3. The first column highlighted, r square change, shows the increase in variation explained by the addition of the interaction term (i.e., the change in r 2).you can see that the change in r 2 is reported as.068, which is a proportion.more usually, this measure is reported as a percentage so we can say that the change in r 2 is 6.8% (i.e.,.068 x 100 = 6.8%), which is the percentage.

If the degree of correlation is high enough between variables, it can cause problems when fitting.

Finance add in for excel hoadley. Python for finance algorithmic trading article datacamp. In addition, multicollinearity test done to avoid. $\begingroup$ use the vif technique to deal with multicollinearity.

However, this is required that dv should be continuous data.

Using spss, multicollinearity test can be checked in linear regression model. A simple explanation of how to test for multicollinearity in spss. Just a quick guide on detecting multicollinearity in spss. Eib courses tufts fletcher school.

If vif value is 1 then multicollinearity doesnot exists within independent variable.

It is used when we want to predict the value of a variable based on the value of two or more other variables. The interpretation of this spss table is often unknown and it is somewhat difficult to find clear information about it. Correlations of 0.8 or above suggest a strong relationship and only one of the two variables is needed in the regression analysis. Multiple regression analysis using spss statistics laerd.

This leads to problems with understanding which variable contributes to the explanation of the dependent variable and technical issues in calculating an ordinal regression.

Similarities between the independent variables will result in a very strong correlation. Nevertheless, in ordinal data, dv is ordinal data, may i. The tutorial is based on spss version 25.