The intuition for this is simple. But if we want to predict which group will bear most of the burden, all we need to do is examine the elasticity of demand and supply. A tax of $1 per frame levied on picture frames will decrease the effective price received by sellers of picture frames by.

Education resources for teachers, schools & students

In a case where the supply curve is perfectly inelastic and the demand curve is somewhat.

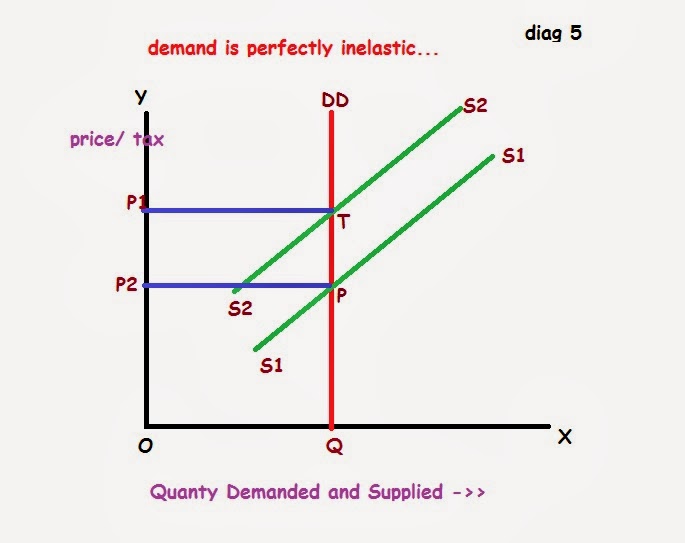

We'll think it through with our supply and our perfectly inelastic demand curve.

It means the price paid by the consumers rises substantially and they bear most of the load of the taxation. The intuition for this is simple. 3 tax revenue is larger the more inelastic the demand and supply are. How does tax affect a perfectly inelastic supply?

% change in price = 10/30 = 33.3%.

Tax incidence is the analysis of the effect a particular tax has on the two parties of a transaction; The producer that makes the good and the consumer that buys it. I'm just making it, instead of a percentage, i'm just doing it as a fixed amount so that we get kind of a fixed shift in. When one party bears the tax burden if supply is perfectly elastic or demand is perfectly inelastic, consumers will bear the entire burden of a tax.

When supply is more elastic than demand, consumers will bear more of the burden of a tax than producers will.

Price supply $3.50 3 2.50 demand demand + $1 tax 1,200 1,500 quantity reference: Gets $4 also and the consumer pays $6. In this case, a higher percentage of the tax burden is borne by the consumer. Suppose that the demand for picture frames is elastic and the supply of picture frames is inelastic.

Inelastic supply here, supply is highly inelastic—as the price changes, the quantity produced changes a little i.

When supply is more elastic than demand, the tax burden falls on the buyers. In this case, an increase in price from £30 to £40 has led to an increase in quantity supplied from 15 to 16. In this case, if a new sales tax. With a pes of 0.2, it is inelastic because pes is less than one.

When supply is inelastic and demand is elastic, the tax incidence falls on the producer.

When the demand is inelastic, consumers are not very responsive to price changes, and the quantity demanded remains relatively constant when the tax is introduced. Tax incidence with inelastic supply. The deadweight loss is the area of the triangle bounded by the right edge of the grey tax income box, the original supply curve, and the demand curve. The tax increases the market price from £17 to £25.

In the tobacco example above, the tax burden falls on the most inelastic.

The producer burden is £4* 95 = £380; When the government imposes a tax on a market having such elasticities, the price received by sellers does not fall much, so sellers bear only a small load of taxation. If demand is more inelastic than supply, consumers bear most of the tax burden, and if supply is more inelastic than demand, sellers bear most of the tax burden. If demand is more inelastic than supply, consumers bear most of the tax burden, and if supply is more inelastic than demand, sellers bear most of the tax burden.

Hence option a is correct.

When supply is elastic or demand is inelastic, then the buyer pays most of the tax graphs 1 and 3. The greater part of the incidence is. Similarly, when a government introduces a tax in a market with an inelastic supply, such as, for example, beachfront hotels, and sellers have no alternative than to accept lower prices for their business, taxes do not greatly affect the equilibrium quantity. Therefore when the supply is elastic and demand is inelastic the majority of the burden of tax is on the part of.

A tax cause a deadweight loss because it causes buyers and sellers to change their behavior.

New quantity traded, qt , the supplier gets $2 per unit (pts), the government. Most of the tax will be passed onto consumers. Sellers of the good will bear most of the burden of the tax. When demand happens to be price inelastic and supply is price elastic, the majority of the tax burden falls upon the consumer.

Government can impose higher taxes on goods with inelastic demand, whereas, low rates of taxes are imposed on commodities with elastic demand.

Placing a tax on a good, shifts the supply curve to the left. Therefore price elasticity of supply ( pes) = 6.6/33.3 = 0.2. Perfectly inelastic supply means that suppliers will provide the same amount of product regardless of the price. When supply is more elastic than demand, buyers bear most of the tax burden.

If demand is inelastic most of the tax burden will be borne by the consumer.

Tax incidence can also be related to the price elasticity of supply and demand. % change in supply = 1/15 = 6.66%. Demand for cigarettes is very price inelastic. What ends up getting passed is a tax of $10 per vial.

More elastic supply and less elastic demand.

When the demand is inelastic, consumers are not very responsive to price changes, and the quantity demanded remains relatively constant when the tax is introduced. When a tax is imposed on a good for which the supply is relatively elastic and the demand is relatively inelastic, buyers of the good will bear most of the burden of the tax. In this case, the tax is £12. Market inefficiency occurs when goods within the market are either overvalued or undervalued.

If demand is more elastic than supply, producers will bear the cost of the tax.

Key points 1 tax incidence is the manner in which the tax burden is divided between buyers and sellers. If demand is inelastic, a higher tax will cause only a small fall in demand. When demand is inelastic, governments will see a significant increase in their tax revenue. Taxes and perfectly inelastic demand.

A perfectly inelastic supply curve means quantity supplied would not change in response to a price change;

Typically, the incidence, or burden, of a tax falls both on the consumers and producers of the taxed good. 2 the tax incidence depends on the relative price elasticity of supply and demand. The consumer burden is £8 *95 = £760; When supply is elastic and demand is inelastic, the tax incidence falls on the consumer.