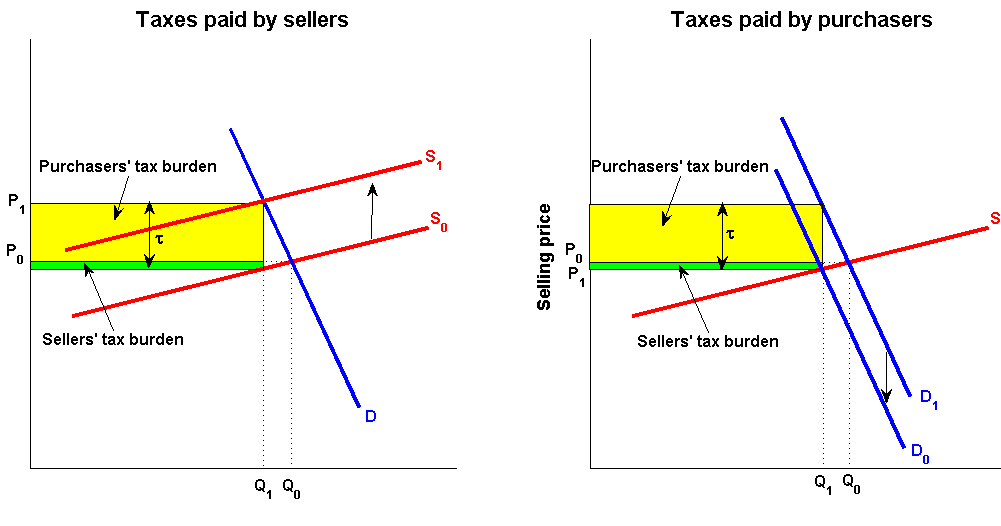

If a tax is imposed on a market with inelastic demand and elastic supply: If supply is perfectly elastic or demand is perfectly inelastic, consumers will bear the entire burden of a tax. Buyers will bear most of the burden of the tax.

Elasticity Introduction to Microeconomics

For soda, within a certain price range our demand is inelastic.

Furthermore, a more elastic supply curve.

When supply is more elastic than demand, buyers bear most of the tax burden. The greater part of the incidence is. E s = elasticity of supply; The tax incidence depends on the relative price elasticity of supply and demand.

Sellers will bear most of the burden of the tax.

When a tax is imposed on a good for which the supply is relatively elastic and the demand is relatively inelastic, buyers of the good will bear most of the burden of the tax. Neither the buyer nor the seller will bear the burden of the tax. When supply is more elastic than demand, buyers bear most of the tax burden. Tax revenue is larger the more inelastic the demand and supply are.

If demand is inelastic most of the tax burden will be borne by the consumer.

What is tax buoyancy in economics? In the tobacco example, the tax burden falls on the most inelastic side of the market. 3 tax revenue is larger the more inelastic the demand and supply are. We can draw conclude from this example that, for any given demand, the more elastic is supply, the.

When supply is elastic and demand is inelastic, the tax incidence falls on the consumer.

If demand is more inelastic than supply, consumers bear most of the tax burden, and if supply is more inelastic than demand, sellers bear most of the tax burden. Tobacco products and certain medications have a low price elasticity of demand and the reasons for their inelasticity varies. Dt= change in amount of tax. When demand is more elastic than supply, producers bear most of the cost of the tax.

By contrast, if price swings have a big impact, then our response is elastic.

If demand is more inelastic than supply, consumers bear most of the tax burden, and if supply is more inelastic than demand, sellers bear most of the tax. Elastic demand means there is a substantial change in quantity demanded when another economic factor changes (typically the price of the good or service), whereas inelastic demand means that there. Who pays more tax if demand is elastic and supply is inelastic? As with medication, if price changes a lot and the quantity we buy remains pretty constant, then our demand is inelastic.

When supply is inelastic and demand is elastic, the tax incidence falls on the producer.

Use the tools of consumer surplus and producer surplus in your answer. If this market has very elastic supply and very inelastic demand, how would the burden of a tax on rubber bands be shared between consumers and producers? When a tax is imposed on a good for which both demand and supply are very elastic quizlet? If you have a formula for a supply curve and a demand curve, you can calculate all sorts of things, including the market clearing price, or where the two lines intersect, and the consumer and producer surplus.

With other products, however, the burden of the tax can be very different.

Price supply $3.50 3 2.50 demand demand + $1 tax 1,200 1,500 quantity reference: The demand for the good may be inelastic because of personal preference, meaning the consumer prefers some amount of consumption regardless of the good’s price. Upon the supplier, on account of the relatively inelastic supply. When supply is more elastic than demand, buyers bear most of the tax burden.

Tax revenue is larger the more inelastic the demand and supply are.

Tax incidence is the analysis of the effect a particular tax has on the two parties of a transaction; When supply is more elastic than demand, buyers bear most of the tax burden. If this market has very inelastic supply and very elastic demand, how would the burden of When demand is more elastic than supply, producers bear most of the cost of the tax.

The tax incidence depends on the relative price elasticity of supply and demand.

When demand is more elastic than supply, producers bear most of the cost of the tax. Asked aug 15, 2017 in economics by zoeye. When the demand is inelastic, consumers are not very responsive to price changes, and the quantity demanded remains relatively constant when the tax is introduced. That means buyers bear a bigger burden when demand is more inelastic, and sellers bear a bigger burden when supply is more inelastic.

If the demand curve is very inelastic and the supply curve is very elastic in a market, then the sellers will bear a greater burden of a tax imposed on the market, even if the tax is imposed on the buyers.

But if one wants to predict which group will bear most of the burden, all one needs to do is examine the elasticity of demand and supply. Buyers and sellers will each bear 50 percent of the. 2 the tax incidence depends on the relative price elasticity of supply and demand. Where, dt b =buyer’s share in tax;

100 per unit of product.

When supply is more elastic than demand, buyers bear most of the tax burden. Conversely, if demand is perfectly elastic or supply is perfectly inelastic, producers will bear the entire burden of a tax. E d = elasticity of demand; If taxes are involved, you can also calculate new market prices and quantities, deadweight loss (or the loss of market efficiency.

The burden of the tax will be shared equally between buyers and sellers.

This is the currently selected item. Though not typical, it is possible for either consumers or producers to bear the entire burden of a tax. Tax revenue is larger the more inelastic the demand and supply are. Maybe a 35% tax (or more) would nudge us into elastic territory.

Sellers of the good will bear most of the burden of the tax.

When demand is more elastic than supply, producers bear most of the cost of the tax. Buyers will bear most of the burden of the tax. The more elastic the demand and supply curves, the lower the tax revenue. The burden of a tax falls most heavily on someone who can't adjust to a price change.

Conversely, if demand is perfectly elastic or supply is perfectly inelastic, producers will bear the entire burden of a tax.

Key points 1 tax incidence is the manner in which the tax burden is divided between buyers and sellers. If demand is relatively inelastic and supply is relatively elastic, then consumers bear more of the burden of a tax. Hence option a is correct. The producer that makes the good and the consumer that buys it.

The tax incidence depends on the relative price elasticity of supply and demand.