The maximum profit is calculated by taking the difference between the stock price and the short call, then. Using the collar option strategy means the investor keeps the cash credit, regardless of the price of the underlying stock when the options expire. It is best suited for bargain hunting in market conditions that.

The Option “Collar” Strategy to Hedge Your Stock Positions

All » tutorials and reference » option strategies » collar.

The collar strategy is an option strategy that allows the investor to acquire downside protection by giving up upside potential on a stock that he currently owns.

The collar option strategy is a popular option trading technique that also happens to be one of the most complicated. A collar is an options strategy used by traders to protect themselves against heavy losses. In short, you are long stock, long put, and short call at the same time. Until the investor either exercises his put and sells the underlying stock, or is assigned an exercise notice on the written call and is obligated to sell his stock, all rights of stock ownership are retained.

But it does require sufficient capital and there is a higher risk involved provided your buying of ce and pe contracts arent in sync.

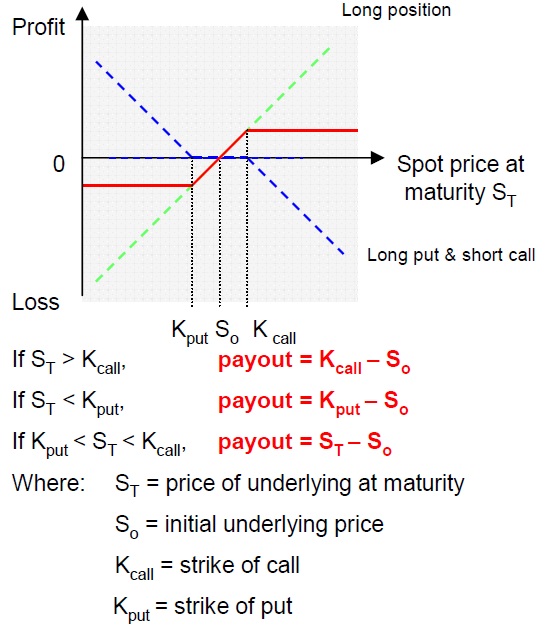

You simply purchase a put on the underlying stock and finance it with the sale of a call. Buying a put option against long shares eliminates the risk of the shares below the put strike, while selling a call option limits the profit potential of shares above the call strike. It is a strategy involving a mix of protective put and covered calls. Collar is a bullish option strategy with three legs, including long position in the underlying asset.

It can hedge the options against the volatility of the market and limit the return of a portfolio within a specified range.

A collar option is a strategy where you buy a protective put and sell a covered call with the stock price generally in between the two strike prices. Collar option strategy when to use a collar. It has limited loss and limited profit. Key takeaways a collar is an options strategy that involves buying a downside put and selling an upside call that is implemented to.

It's where making money in a short time frame si feasible.

A collar option strategy is also known as a hedge wrapper. Collar is one of the most conservative strategies. Collar is a perfect option trading strategy for turbulent times: A collar can be an effective options strategy that is used to place a limit on losses of a volatile stock that is expected to drop in value.

The options collar strategy is simply selling to open an out of the money covered call for every 100 shares of held stock while buying an out of the money protective put option with the same expiration date as the call.

A collar is an options strategy implemented to protect against large losses, but which also puts a limit on gains. A collar option strategy is created to diminish both positive and negative returns of the underlying assets. An investor should consider using a collar if they are bullish on the stock for the long run, but.