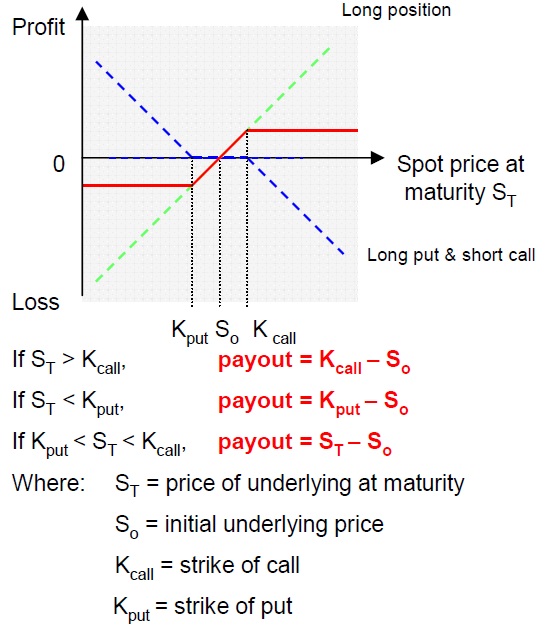

Some investors think this is a sexy trade because. Minimize their downside risk by buying put options; The payoff diagram is figure 1, at the top left.

What is a collar option strategy? When to use it?

Costless collars can be established to fully protect existing long stock positions with little or no cost since the premium paid for the protective.

A straddle is a combination of two options;

Buying the put gives you the right to sell the stock at strike price a. The payoff diagram below shows how losses are limited in our trade scenario, but gains are also capped at the $110 mark. Option strategies and profit diagrams in the diagrams that follow, it is important to remember that the diagrams that follow are based on option intrinsic value, at expiration. Option profit and loss diagrams are visual aids that illustrate where options strategies will make or lose money at expiration based on the underlying asset’s price.

Figure 3 shows the payoff graph for the case when the underlying turns bearish.

Because you’ve also sold the call, you’ll be obligated to sell the stock at strike price b if the option is assigned. Covered calls are becoming very popular strategy for investors who already own stock. That’s thanks to the put and the proceeds from the sale of the call option. It is suited to investors who already own the stock and are looking to:

For all three collars, the call was not assigned, and.

Option profit & loss diagrams. A long call and long put option with the same expiration dates and strike prices. Reasons to consider using a collar option strategy. We will do this right below our existing p/l calculations.

In the diagrams that follow, the ‘kinks’ are at strike prices.

The collar strategy is useful for hedging against losses,. Select the option type and input the quantity, strike price, premium, and spot price. Basically, uber moved sideways in a range from that time until expiration on oct 9 at which point uber closed at $37.27. Usually, the call and put are out of the money.

You can think of a collar as simultaneously running a protective put and a covered call.

To draw the graph, we need to calculate p/l for different levels of underlying price. A collar is an effective strategy when an investor expects a stock to trade sideways or down over a period. Increase their return by writing call options; A collar is an options strategy implemented to protect against large losses, but which also puts a limit on gains.

When more than one leg is in the strategy.

Download the options strategy payoff calculator excel sheet from the end of this post and open it. This is the payoff diagram at the start of collar 1 on september 16. The collar strategy payoff diagram has a defined maximum profit and loss. The protective collar strategy involves two strategies known as a protective put.

Quantity should be negative if you are shorting a particular option.

However, payoff charts become very useful when looking at combinations of options i.e. As you can see from the above payoff chart, a collar behaves just like a long call spread. Take an option straddle for example. We will use these calculations to create a payoff diagram, which is a graph that shows how an option strategy's profit or loss (p/l) changes based on underlying price.