Because you’ve also sold the call, you’ll be obligated to sell the stock at strike. Buying the put gives you the right to sell the stock at strike price a. Understanding payoff graphs (or diagrams as they are sometimes referred) is absolutely essential for option traders.

Profit And Loss Table For Put Option Strategy Deep In The

In figure 7.13, the holder of the collar does pay less than the floor and does not pay more than the cap.

In the previous four parts we have explained option profit or loss calculations and created a spreadsheet that calculates aggregate p/l for option strategies involving up to four legs.for example, the screenshot below shows an iron condor made on.

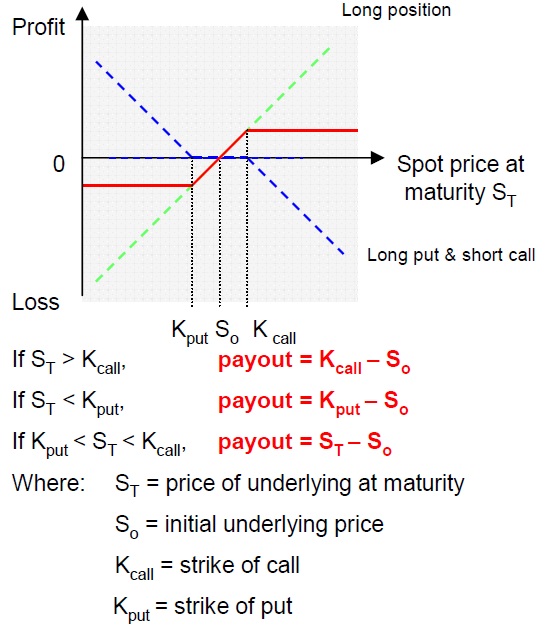

Let’s understand the value and profit payoff of a collar at a high level before diving into the calculations. Payoff diagram and profit calculation. As you can see from the above payoff chart, a collar behaves just like a long call spread. When the interest rate moves up and hits the strike of the cap, the buyer of the cap pays a fixed rate equal to strike.

Suppose a stockm price is 40 and effective annual interest rate is 8%.draw a single payoff and profit diagram for the following option

Minimize their downside risk by buying put options; This is part 5 of the option payoff excel tutorial, which will demonstrate how to draw an option strategy payoff diagram in excel. Access 9 free option books. This workbook teaches the user how to build a workbook that will demonstrate the shape of the payoff function for virtually any combination of put and call o.

A collar is an options trading strategy that is constructed by holding shares of the underlying stock while simultaneously buying protective puts and selling call options against that holding.

The options strategies » collar. Sure, here's a payoff graph of a $35 call option with 60 days to maturity, 25% volatility, 0% dividend yield, 8% interest rate and an underlying price of $40. What we are looking at here is the payoff graph for a covered call option strategy. Mighaugust 24th, 2012 at 3:06am.

Covered calls are becoming very popular strategy for investors who already own stock.

The collar calculator and 20 minute delayed options quotes are provided by ivolatility, and not by occ. Payoff graphs are the graphical representation of an options payoff. Another view of the collar would be in payoff terms, as a function of the future spot rates. The collar strategy payoff diagram has a defined maximum profit and loss.

It is suited to investors who already own the stock and are looking to:

Covered call option payoff graph. Costless collars can be established to fully protect existing long stock. Increase their return by writing call options; If the stock is between the two levels at expiration, both the call and put options will expire worthless.

Occ makes no representation as to the timeliness, accuracy or validity of the information and this information should not be construed as a recommendation to purchase or sell a security, or to provide investment advice.